Richard Kayne

Exploring Richard Kayne’s Background

Growth of Kayne Anderson Capital Advisors

Richard Alan Kayne co-founded Kayne Anderson Capital Advisors with John E. Anderson in 1984. This firm has shown impressive growth over the years and currently manages over $26 billion in assets (Goodreturns). The firm’s success can be attributed to its focus on various investment strategies, which has attracted a diverse client base.

In addition to Kayne Anderson Capital Advisors, Ric also founded Kayne Anderson Rudnick, a traditional investment management firm. This firm was particularly successful, growing to manage over $10 billion in assets before it was sold to the Phoenix Companies in 2001 (Kea New Zealand).

| Company Name | Year Founded | Assets Under Management |

|---|---|---|

| Kayne Anderson Capital Advisors | 1984 | $26 billion |

| Kayne Anderson Rudnick | 2001 | $10 billion |

Philanthropic Contributions

Ric Kayne and his wife Suzanne are well-known for their philanthropic efforts, particularly in New Zealand. They have invested significantly in the country with the aim of establishing it as a premier golfing destination. One of their notable projects is the Tara Iti Golf Course located in Te Arai, north of Auckland. This course, designed by esteemed architect Tom Doak, gained international attention when President Barack Obama played there during his visit to New Zealand in 2018.

Their commitment to philanthropy exemplifies how high net worth individuals can positively impact local communities, fostering not only sports and recreation but also tourism and economic growth in areas like New Zealand’s Te Arai. For more insights into other influential figures in Los Angeles, explore our articles on high net worth Los Angeles, Andrew Cherng, and Peggy Cherng.

Ric Kayne’s Investments and Ventures

Ric Kayne has made considerable strides in the investment world and beyond, establishing impressive ventures that have both financial and cultural impact.

Kayne Anderson Rudnick Venture

Ric Kayne founded Kayne Anderson Rudnick, a traditional investment management firm, which grew to manage over $10 billion in assets. In 2001, he sold the firm to the Phoenix Companies. Under Ric’s leadership, the firm specialized in equities and providing tailored investment strategies for clients, significantly impacting the industry.

| Year | Assets Under Management (AUM) | Event |

|---|---|---|

| 2001 | $10 billion | Sold to Phoenix Companies |

This significant sale showcased Ric’s ability to build and scale financial entities successfully, contributing to his status among high net worth individuals.

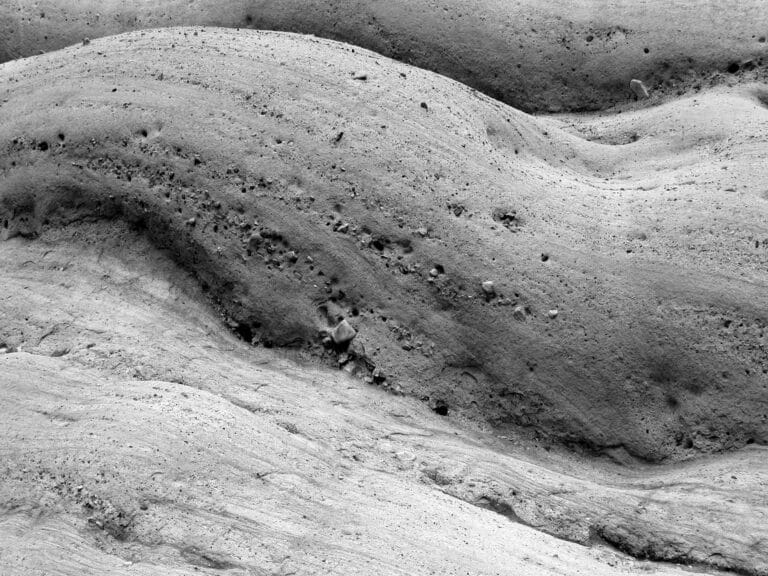

Development of Tara Iti Golf Course

Ric and his wife, Suzanne, have played pivotal roles in establishing New Zealand as a premier golfing destination. One of their notable investments includes the Tara Iti Golf Course, located in Te Arai, north of Auckland. This course, designed by the esteemed Tom Doak, has attracted global attention, even being played by President Barack Obama during his visit to New Zealand in 2018 (Kea New Zealand).

Tara Iti Golf Course has become known for its stunning coastal views and world-class design, contributing to the area’s growing reputation in the golfing community.

| Course | Designer | Notable Event |

|---|---|---|

| Tara Iti | Tom Doak | Played by President Barack Obama in 2018 |

Future Plans in New Zealand

Ric Kayne’s vision does not stop with Tara Iti. He has ambitious plans for further development, including two additional golf courses in the Northland region near Tara Iti and making significant investments in the Queenstown area. These efforts could elevate New Zealand’s status as a key player in global golf tourism, adding to Ric’s legacy in the investment and golf arenas.

These ventures highlight Ric’s commitment to turning New Zealand into a world-class golfing destination while ensuring his investments contribute positively to the local economy. For more information on high net worth individuals like Ric Kayne in Los Angeles, you can explore our page on high net worth los angeles.

Ric Kayne’s Financial Success

Kayne Anderson Capital Advisors’ Net Worth

Ric Kayne is the Founder and co-Chairman of Kayne Anderson Capital Advisors, a prominent manager of alternative investment strategies based in Los Angeles. Established in 1984, the firm has catered to a distinguished clientele comprising institutions, endowments, foundations, family offices, and high net worth individuals. As of October 3, 2024, Kayne Anderson Capital Advisors has an estimated net worth of at least $1.1 billion.

Key Investments and Holdings

Kayne Anderson Capital Advisors has made significant investments across various sectors. The firm holds a 10% ownership stake in several high-value companies. Below is a summary of their most notable investments:

| Company | Ownership Percentage | Shares Owned | Estimated Value |

|---|---|---|---|

| Freshpet Inc | 10% | 4,127,890 | Over $560 million |

| RSP Permian Inc | 10% | 10,626,089 | Over $508 million |

| Altus Midstream Co | 10% | 689,084 | Over $43 million |

These investments are significant contributors to the financial success of Ric Kayne and his firm. Kayne Anderson Capital Advisors also owns a total of five stocks, with values ranging from $43 million to over $500 million, which comprises a substantial portion of their net worth (GuruFocus).

Through strategic investments and management of assets, Ric Kayne has established himself as a remarkable figure in the financial landscape of Los Angeles.

Comparison with Other High Net Worth Individuals

Ric Kayne vs Kanye West

When comparing Richard Kayne and Kanye West, both individuals have established themselves as influential figures in their respective fields. Richard Kayne holds a net worth of approximately $1.32 billion, ranking him as the 2397th wealthiest person globally. In contrast, Kanye West’s net worth is estimated at $1.3 billion. This puts both individuals in similar wealth brackets, with Kayne’s wealth primarily stemming from his co-founding of Kayne Anderson Capital Advisers, which manages over $26 billion in assets (Goodreturns).

| Name | Net Worth | Global Rank | Primary Source of Wealth |

|---|---|---|---|

| Richard Kayne | $1.32 billion | 2397th | Kayne Anderson Capital Advisers |

| Kanye West | $1.3 billion | Similar ranking | Music, Yeezy brand, Real Estate |

The comparison showcases how both men have accumulated significant wealth, albeit in different industries. Kayne has focused on finance and investment management, while West has made his mark in the entertainment and fashion sectors, highlighted by his Yeezy brand and various real estate holdings.

Net Worth Rankings

With their substantial net worths, both Richard Kayne and Kanye West find themselves among other high-net-worth individuals in Los Angeles. Kayne’s current ranking as 675th among billionaires in the United States reflects his influence in the finance industry (Goodreturns). As a point of interest, this positioning places him alongside notable individuals such as Andrew Cherng, Mark Attanasio, and Howard Marks in various wealth rankings.

The world of high net worth individuals is filled with diverse stories and backgrounds. Exploring the differences between these wealth creators can provide valuable insights into the various paths to financial success. For more profiles of high net worth individuals in Los Angeles, check out our overview of high net worth los angeles.

Industry Influence and Contributions

Role in Finance & Investments

Richard Kayne has made significant contributions to the finance and investments industry throughout his career. Starting as an analyst in the mid-1960s with Loeb, Rhodes & Co. in New York, he later became a principal at Cantor Fitzgerald & Co., Inc. Here, he managed private accounts, a hedge fund, and a portion of the firm’s capital.

His most notable venture is the founding of Kayne Anderson Rudnick, a traditional investment management firm that he grew to manage over $10 billion in assets before its sale to the Phoenix Companies in 2001 (Kea New Zealand). This venture not only showcased his skills in asset management but also highlighted his ability to navigate the competitive landscape of finance effectively.

As of October 3, 2024, Kayne Anderson Capital Advisors has an estimated net worth of at least $1.1 billion, demonstrating Kayne’s acumen in investment management. The firm is known for its strategic investments, including owning about 4,127,890 shares of Freshpet Inc, valued at over $560 million (GuruFocus).

Expansion and Management of Assets

Under Richard Kayne’s leadership, the expansion of assets has been a hallmark of his career. Kayne Anderson Capital Advisors LP continues to manage a substantial portfolio, with investments including 689,084 shares of Altus Midstream Co, worth approximately $43 million.

The firm’s investment strategy emphasizes long-term growth, guiding its approach in a diverse range of markets. As a testament to his management capabilities, Kayne has cultivated a reputation for understanding market dynamics and identifying lucrative opportunities, making him a respected figure among high net worth individuals in Los Angeles.

The success and influence Richard Kayne has had within the finance and investments sector resonates with those who are keen to explore successful examples in the world of high net worth individuals. For more insights into other prominent figures, check out articles on high net worth los angeles and notable individuals like Steven Mnuchin and George Roberts.

Noteworthy Achievements

Co-founding Kayne Anderson Capital Advisers

Richard Kayne, known for his sharp financial acumen, co-founded Kayne Anderson Capital Advisers in 1984 alongside John E. Anderson. Under their leadership, the firm has flourished and currently manages over $26 billion in assets. Their commitment to investment strategy and client relations has solidified Kayne’s reputation in the competitive financial landscape. The firm has become a go-to for wealthy clients seeking reliable investment management.

Before this venture, Ric was instrumental in establishing Kayne Anderson Rudnick, a traditional investment management firm that achieved over $10 billion in assets before its sale in 2001 to the Phoenix Companies. His experience and leadership have significantly influenced the direction of investment management in Los Angeles.

Current Portfolio Overview

Today, Kayne Anderson Capital Advisers holds a diverse portfolio, expanding its reach across various sectors such as energy, real estate, and infrastructure. The company focuses on identifying unique investment opportunities and delivering value to its clients.

Here’s a simplified breakdown showcasing the types of assets currently managed by Kayne Anderson Capital Advisers:

| Asset Class | Estimated Assets Managed ($ Billion) |

|---|---|

| Energy | 12 |

| Real Estate | 8 |

| Infrastructure | 6 |

| Private Equity | >1 |

This diversification not only mitigates risks but also enhances potential returns for investors. The strategic focus on alternative asset classes sets Kayne Anderson apart from other investment firms, appealing to high net worth individuals seeking profitable avenues for wealth growth.

As one explores the profiles of prominent figures in Los Angeles, Ric Kayne stands out for his achievements and contributions to the financial industry. His influence and success resonate as an example for aspiring investors and business leaders alike. For more insights into other high net worth individuals in the area, visit our section on high net worth Los Angeles.

Insights into Personal Wealth

Net Worth Fluctuations

Richard Kayne’s financial status has seen significant changes over the years. As of 2023, his net worth is reported to be $1.32 billion, reflecting a decrease of $585 million compared to the previous year’s value of $1.90 billion. This change highlights the volatility often experienced by high net worth individuals, influenced by various market conditions and personal investments.

| Year | Net Worth (in billion USD) | Change in Net Worth (in million USD) |

|---|---|---|

| 2022 | 1.90 | – |

| 2023 | 1.32 | -585 |

Richard Kayne currently holds the 2397th position globally among wealthy individuals and ranks 675th among billionaires in the United States. Such rankings reflect not only his financial status but also the competitive environment within the high-net-worth sphere (Goodreturns).

Source of Wealth

Richard Kayne’s wealth primarily stems from his role as a co-founder of Kayne Anderson Capital Advisors, which was established in 1984 alongside John E. Anderson. The firm is recognized for its management of over $26 billion in assets, showcasing significant success in the finance industry (Goodreturns).

This venture is a cornerstone of Kayne’s wealth accumulation and reflects his strategic investments in various sectors. His experience in the financial sector has equipped him with the skills necessary to navigate and capitalize on lucrative opportunities. Kayne’s success story serves as an example within the Los Angeles high-net-worth community, making him a notable figure in the region. For more insights into other affluent individuals in Los Angeles, consider exploring profiles of Andrew Cherng, Peggy Cherng, and Ken Moelis.

Legacy and Continued Growth

Impact on Finance Industry

Ric Kayne, as the founder and co-chairman of Kayne Anderson Capital Advisors, has made significant contributions to the finance industry. His firm, based in Los Angeles, specializes in alternative investment strategies and caters to a diverse clientele including institutions, endowments, foundations, family offices, and other high net worth individuals. This positioning illustrates the firm’s commitment to innovative investment practices that enhance client portfolios.

Ric’s earlier venture, Kayne Anderson Rudnick, transformed traditional investment management by growing the company’s assets to over $10 billion before its sale in 2001. This legacy of growth and innovation has influenced many within the industry and set a precedent for future investment strategies.

| Achievement | Description |

|---|---|

| Founder of Kayne Anderson Capital Advisors | Leader in alternative investment strategies |

| Growth of Kayne Anderson Rudnick | Grew to over $10 billion in assets before sale |

Future Prospects and Ventures

Looking ahead, Ric Kayne continues to explore new opportunities. He plans to develop two additional golf courses in the Northland region near Tara Iti, enhancing the appeal of the area as a destination for golf enthusiasts (Kea New Zealand). Moreover, he is eyeing significant investments in the rapidly growing Queenstown area, which indicates his ongoing commitment to fostering growth in various sectors.

This proactive approach not only showcases Ric’s business acumen but also his dedication to creating sustainable projects that positively impact local communities. His vision for future ventures aligns with the evolving landscape of investment opportunities, ensuring that he remains a respected figure in the finance sector.

As Ric Kayne continues to innovate and expand, his influence in the high net worth landscape of Los Angeles remains significant. For more on high net worth individuals in the area, check our article on high net worth los angeles.